The insurance industry in Kenya is undergoing one of its most significant transformations in history. For many years, insurance has been seen as slow, confusing, and sometimes inaccessible to ordinary people. But with technology reshaping almost every sector of the economy, insurance is finally catching up. At the same time, new regulations are being introduced to make sure the industry is fair, transparent, and financially strong.

This blog explains how digital tools and new rules are shaping the future of insurance in Kenya. More importantly, we’ll look at what this means for you as a policyholder, whether you already have a cover or are considering getting one.

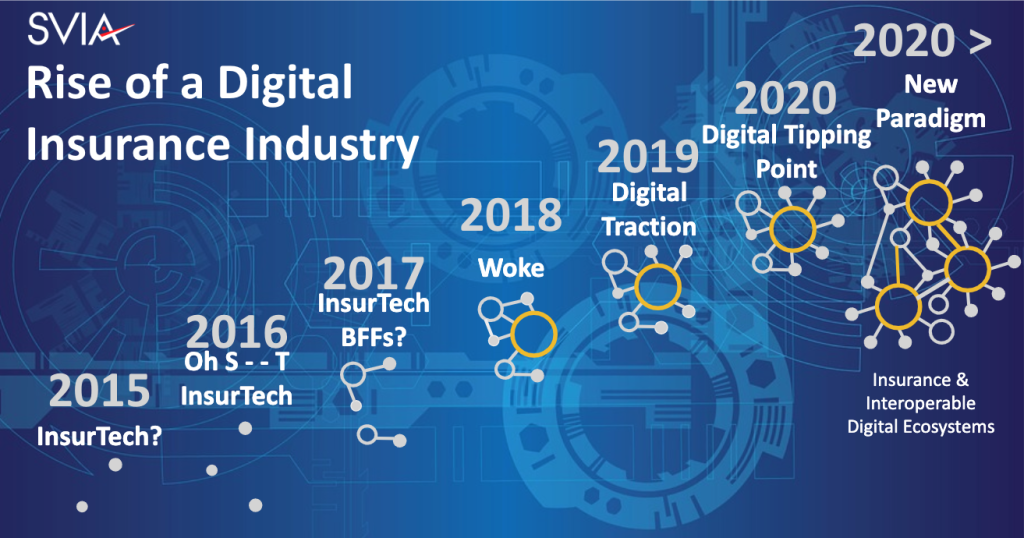

The Rise of Digital Insurance

Kenya is known as a hub for mobile innovation, thanks to M-Pesa and the widespread spread of smartphones. Insurance is now following this trend. Instead of needing to visit a branch or fill in paperwork, you can now buy or manage your insurance directly on your phone.

Mobile-first insurance platforms, WhatsApp chatbots, and USSD codes are enabling users to sign up for health, motor, and even life insurance within minutes. For many people, this removes the old frustrations of endless paperwork and long waiting times.

Digital transformation is not just about convenience; it is about inclusion. In the past, many people in rural areas or in the informal sector found insurance too complicated or too far from reach. With mobile insurance, even a small business owner in a village can protect their goods or take medical cover. This has opened doors to products like microinsurance, which allow customers to pay very small premiums tailored to their income levels.

What It Means for Policyholders

For you as a policyholder, digital transformation brings several benefits. First, it means greater convenience. You can buy and renew policies, make claims, or check your policy details at the touch of a button. Second, it creates transparency. Most apps and online platforms let you track your claims and payments, so you know exactly what is happening. Third, it allows for personalization. You can compare products easily and choose plans that match your lifestyle and budget.

Perhaps the biggest benefit is speed. Claims that used to take weeks or months to process can now be settled in days, or even instantly in some cases, thanks to automation and artificial intelligence.

Regulatory Reforms Reshaping the Industry

While technology is changing how insurance is delivered, regulation is ensuring that insurance companies remain trustworthy and stable. One of the biggest recent shifts is the replacement of the National Health Insurance Fund (NHIF) with the Social Health Authority (SHA). This change is aimed at expanding access to healthcare for all Kenyans under one structure, ensuring that services are more coordinated and less fragmented.

Another important reform is the move toward risk-based supervision. This means insurance companies are now required to maintain stronger financial buffers depending on the types of products they offer. In simple terms, it ensures that insurers can meet their promises to you when you need them most.

Additionally, new international accounting standards such as IFRS 17 are being rolled out. While this may sound technical, for policyholders it translates to clearer and more transparent financial reporting. You will be able to see, in a much simpler way, whether your insurer is financially healthy.

Why These Changes Matter to You

These reforms matter because they are designed to protect you. With stronger capital requirements, you are less likely to lose your money if an insurer collapses. With new health reforms, you will be able to access services in a more organized way. And with clearer reporting, you will be better informed about the companies you choose to trust with your premiums.

The Big Picture

When you combine digital transformation with regulatory reforms, the future of insurance in Kenya looks promising. Insurance is becoming more accessible, more transparent, and more responsive to customer needs. At the same time, the industry is being strengthened so that policyholders can trust insurers to keep their promises.

Conclusion

The insurance industry in Kenya is no longer the slow and rigid sector it once was. Through technology, it is becoming faster and more inclusive. Through regulation, it is becoming stronger and more reliable. As a policyholder, this is the best of both worlds—more convenience and choice, alongside greater protection and stability. The challenge now is for both insurers and customers to embrace these changes fully, ensuring that insurance plays its true role of protecting people when they need it most.